StrIPO

A case study on the fintech giant's prolonged IPO.

Stripe is one of the world's most successful fintech companies. The company was founded in 2010 by the Collison brothers – John and Patrick – after successfully going through Y Combinator's 2009 Summer batch. Stripe has since transformed online payment processing with its suite of developer-friendly products, rendering it the financial infrastructure for enterprises of all sizes, from startups to e-commerce mammoths like Amazon and Shopify.

Stripe’s payment processing platform allows companies globally to accept payments online and manage transactions from their websites and mobile applications. It is available in over 40 countries and over 135 currencies, making it an excellent option for businesses with a global customer base. Its services also include fraud detection, subscription billing, and international payments.

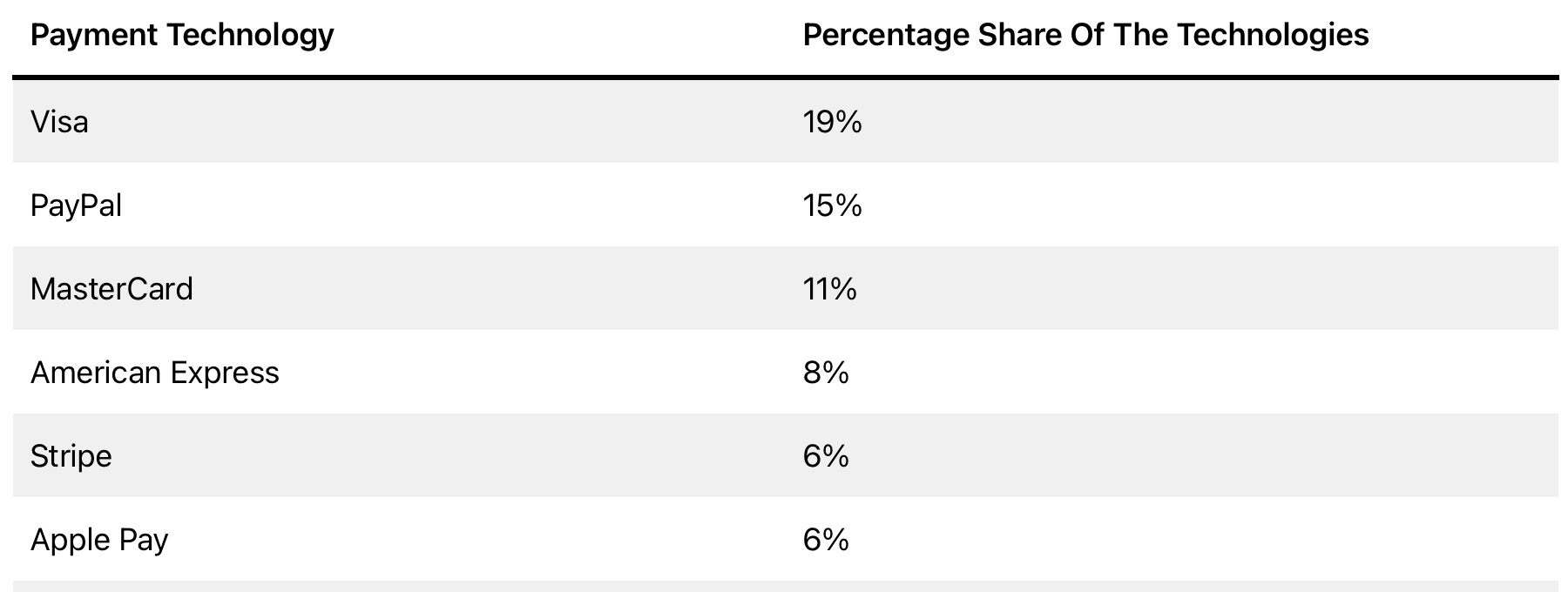

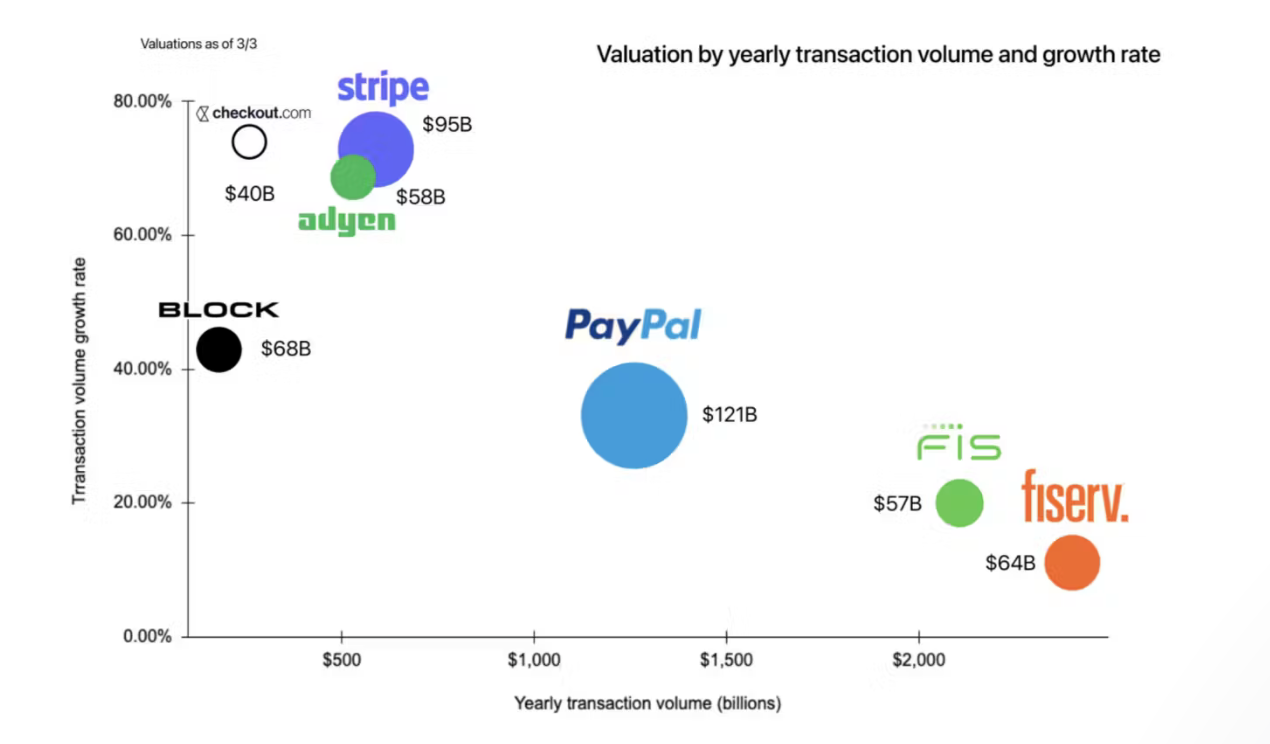

Here's how Stripe ranks alongside public payment processing companies:

Today, Stripe is the 4th most valuable private company in the world with a valuation of ~$70 billion, following a successful Series I round – yes, you read that right – in March 2023. Most VC-backed companies, following the conventional lifecycle, would raise venture funding in the early-stage (pre-seed to Series A), scale (Series B to Series C) and eventually later stage (often Series D-F) before proceeding to IPO. Massive enterprises like Stripe have gone public before reaching later rounds like Series E or F. Case in point: Uber, Twitter, and Zoom all opted for an IPO after raising large Series D rounds.

Stripe has raised over $9 billion across 19 funding rounds since its inception – with the latest being a $6.5 billion Series I round at $50 per share. It's easy to see why investors and enthusiasts alike have been speculating about its future, with rumours about an IPO looming for years.

In January of 2023, CNBC the Collison brothers told employees they were planning to either take the company public within the next year or let employees sell their shares. That timeline elapsed with no IPO announcement, and John Collison confirmed in an interview with Fortune that they had “no news to share” about an initial public offering. Yet, Stripe may be feeling pressure from investors. The company successfully closed a $694m share sale in February 2024 with the aim of providing $65 billion in liquidity to employees through a tender offer.

Stripe have been fairly open about their financial performance, and for good reason:

- The Collison brothers reported >$1 trillion in gross transaction volume (GTV) for the first time in 2023, a 25% increase compared to 2022, and report Stripe as being cash-flow positive.

- Steadily increasing net revenue (estimated at $16 billion dollars, ~15% up from $14 billion in 2022).

- Consistently high EBITDA margins (estimated at 20-25% based on GTV and 10+ acquisitions).

Evidently, Stripe does not appear to be in dire need of capital that would urgently necessitate a public offering. Despite this, there is delayed pressure from early investors to IPO. If Stripe were to go public, I believe we could expect an 8-9x multiple (2x above industry standard), while at the same time accounting for dilution discounts. This could result in a valuation ranging from just above their $95 billion peak private valuation from 2021 to just shy of $145 billion. Although recent high-scale fintech IPOs such as Robinhood and Klarna have experienced post-IPO valuation cuts, I don't expect Stripe to receive a discounted valuation given its strong operating metrics and cemented market position.

A move into the public markets could theoretically provide access to larger capital long-term, enabling further growth and potentially offering more varied compensation options for former and current employees.

However, going public could present complications, such as increased governance (due to inevitable restructuring), and regulatory pressures heightened by its recent acquisitions of companies like Paystack (Africa), Recko (India), and LemonSqueezy (U.S.-based, but with users >135 countries). Also, with Stripe recently authorised its merchants in the U.S. to receive the stablecoins such as USDC through their online checkout pages.

Should Stripe choose not to IPO, it has the following options:

Stock buyback:

- Upside: Would likely reduce outstanding shares, thereby increasing earnings per share (EPS) for current shareholders and improving financial metrics.

- Downside: Requires significant capital, which could otherwise be reinvested into future M&A or growth opportunities in adjacent markets.

Divestiture:

- Upside: Allows Stripe to sell off non-essential or underperforming business units to raise capital and sharpen focus on core business areas.

- Downside: May be time-consuming, difficult, and complex given its scale. This could also reduce product diversification and affect market positioning.

Remaining private:

- Upside: Unparalleled product freedom minus the scrutiny and regulatory burdens of public markets.

- Downside: Capped access to larger funding sources in the long run.

Ultimately, Stripe's market presence in the payment processing landscape is unlikely to be affected, regardless of the outcome. Stripe is in a uniquely comfortable position to decide whether or not to go public, and understandably so: after building a profitable and cash-flow-positive payments titan – likely beyond their wildest dreams – the Collison brothers have earned their stripes...and can now do whatever the hell they want.

Edit: Stripe acquired stablecoin platform Bridge for $1.1bn (October 2024).