07.24: LLMs for LLMs

The greenback boogie, doobie deals & sports APIs.

My favourite early-stage deals from July 2024:

- Pelotero is a player intelligence platform for sport coaches which recently raised a $3m seed round led by Greg Ciongolli and Frederic Kerrest (SBJ). I’m a big proponent of sports tech products with some conceivable viability and foreseeable scalability – see Twelve Labs and Spiideo from June’s recap. Pelotero appears to be focusing primarily on baseball; it may be worth eventually expanding to other sports such as tennis where player intelligence can be especially useful.

- After.com, helps families navigate end-of-life services including funerals and cremations. After.com raised a $10m Series A round led by HIPstr, the early-stage investment arm of HighPost Capital (YF). I believe they’re solving something pretty useful by essentially digitising the end-of-life process (which happens to be recession-proof). Planning a funeral can be extremely difficult given the time pressure, the complex and cumbersome process, all underscored by intense grief. There are over 3m deaths in the USA annually and After is currently based in 6 states – I expect them to scale over the next 3-5.

- 44.01 is a climate startup eliminating CO2 permanently through safe, scalable & permanent carbon removal. 44.01 raised a $37M Series A led by Equinor Ventures (EN). 44.01, originally based in Oman, have recently expanded into the UAE on their mission to eliminate CO2. Albeit an ambitious goal, the team has deep geologic and mineralisation expertise with decades of technology experience and recent progresses to show for their value-driven efforts.

- Nala, a payments and remittance startup enabling payments to Africa, raised a massive $40m Series A led by Acrew Capital (TC). I started following Nala after a deep dive of the YC directory earlier in the year. A $40m Series A seems steep, but they’ve managed to hack 10x revenue growth and profitability this year despite the growing number of remittance startups in Africa. The Series A is supposedly geared around Rafiki, their new B2B payments tool, which directly integrates with banks and mobile money providers.

- Overseed, a French medtech startup producing therapeutic cannabis, announced a €6.7 million Series A led by Anthony Bourbon’s Blast Club (EU). With this round, Overseed is poised to to become first French manufacturer of 100% medical cannabis medicines. Overseed will develop its extracts with Stanipharm CDMO, an expert in the production of active ingredients, in particular by supercritical CO2 extraction.

Analysis: The greenback boogie

I’ve noticed a growing number of legaltech startups raise venture funding over the last few months. Here are a few standouts:

- Luminance is a legal-grade AI software for corporate, diligence & discovery. Luminance raised a $40m Series B in April led by March Capital (ironic).

- Robin AI helps legal teams review contracts 80% faster. Robin AI secured a $26 million Series B round in January led by Temasek.

- Ironclad is a contract repository which includes a chatbot for contract management tasks. Ironclad has raised over $333m total and valued at over $3bn.

- Xapien is an AI-powered due diligence tool which analyses online media, leak sites and corporate records. Earlier this month, Xapien raised £8m in a Series A led by YFM Equity Partners.

- Wordsmith is the AI workspace for lawyers which includes workflow integrations. Wordsmith raised a $5m seed round in June led by Index Ventures.

- Solve Intelligence (YC W23) uses AI to help attorneys write patents. Solve raised $3m at the end of last year led by Y Combinator and Amino Capital.

This is a non-exhaustive list, but the common theme is crystal clear: AI – and LLMs more specifically – are enabling the growth of legaltech sector which may not have been possible otherwise. For those not outsourcing their LLMs, numerous top firms such as Linklaters and A&O Shearman have developed their own in-house GenAI tools due to concerns surrounding privacy and confidentiality.

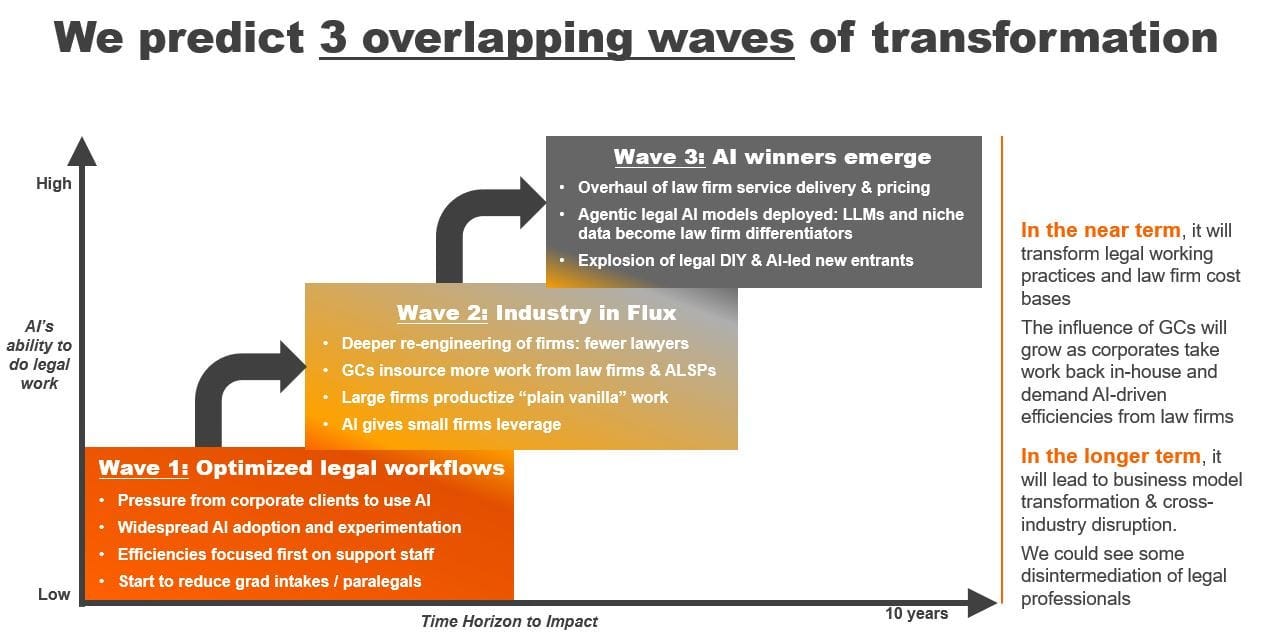

According to the Thomson Reuters Future of Professionals Report, 70% of legal professionals said they believe AI and Gen AI will have a transformational or high impact on the legal profession within the next five years — more than any other trend, including the economy, regulation, and activities around environmental, social & governance (ESG) issues.

Thomson Reuters postulate a near-full automation of certain roles in the legal industry 5-10 years from now:

However, this is quite contingent upon the rate of development of the products themselves and a concurrent ability to generate accurate results while protecting client & team data.

While I don’t believe LLMs will become widespread at medium- to large-sized firms, I expect an upward trend in medium- and large-sized firms and possibly replacing in-house counsel entirely. Gartner predict the legal tech market will be worth >$50bn by 2027.

As GenAI transforms the legal industry, we may note increased efficiency across teams, potentially enabling larger firms to accelerate & scale more easily. We may even see an erosion of the billable business model in light of new advancements.

I’m particularly interested in whether we’ll see products directed towards teams dealing with criminal cases instead of primarily corporate advisory and/or transactions.